First cut in the South of England. Send us recent pictures to be featured.

UP & RUNNING

We aim to bring to you, weekly digestible snippets on investing in agriculture. This can range from soil regeneration strategies in Brazil to the ideal conditions for seaweed growth in Tasmania.

We hope you find enjoyment in our releases while learning something new!

Please note that any topic within this newsletter is not financial advice or a recommendation to invest. Rather, it’s an opportunity to highlight exciting areas of agriculture. If you would like to explore further, please conduct additional research and speak to a professional advisor.

MARKETS

Coffee ‘C’ (ICE) | USD/Lb | 234.20 | +2.29% |

Cotton #2 (ICE) | USD/Lb | 71.74 | +1.07% |

Cocoa (ICE) | USD/Mt | 7,865.00 | +0.19% |

Live Cattle (CME) | USD/Lb | 186.43 | +0.27% |

Wheat (CBOT) | USD/bu | 582.25 | -1.40% |

TOPIC #1 - CHINA’S CROP CATASTROPHE?

Just last week, we were discussing China’s trade restrictions on EU commodities, particularly pork. Recent developments may lead to a change in China’s stance.

Exceptionally hot weather, resulting in droughts, floods, and typhoons, is increasing the risk levels for Chinese crops. The latest news indicates that a dam breach in the Hunan province led to the evacuation of more than 5,000 people and damage to rice fields. Flood alerts have been issued.

China continues to grapple with record levels of precipitation and an unprecedented number of typhoons. Severe climate challenges can and will put pressure on local supply chains, especially now that China has started moving production centres away from geographically advantageous positions.

WHATS NEXT?

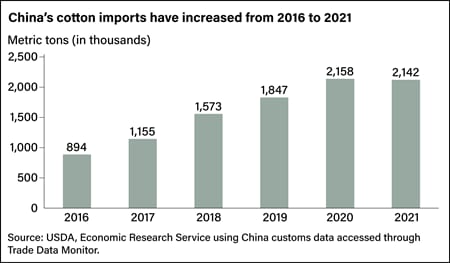

The increased risk of heatwaves, which we are witnessing not just in China, is likely to reduce the output of crops such as cotton and rice. This reduction will impact domestic supply and create further reliance on import markets.

Australia, a country likely to benefit from this increased demand, is well-positioned for additional exports. Cotton production in Australia is set for a fourth consecutive year of high production in 2024/2025, forecasted at 5.5 million bales, resulting in the third-largest crop. Australia has seen significant development in the Northern Territory, with institutional investors allocating capital to property development. Properties are being upgraded from core beef production to cotton production, developing infrastructure and utilising ports out of North Australia to compete with the longer supply chains from Chinese domestic regions such as Xinjiang Uyghur.

To accommodate the growing textile industry in China and its increased demand for cotton, Chinese authorities have supplemented the tariff-rate quota with an additional ‘sliding scale’. This system has increased the share of imported cotton to roughly 20%, and the market could expect this to increase to 40% over the coming years.

TOPIC #2 - BIOSTIMULANTS

Biostimulants are substances, cultures of microorganisms, or mixtures of materials that promote plant growth. These stimulants are designed to stimulate the natural processes that plants use to absorb nutrients, resist stress, and improve their overall quality.

By activating the plant’s inherent biochemical pathways, biostimulants support improved growth and development. Although they are not classified as fertilisers or pesticides, they can complement these products in an integrated crop management system. However, farmers are successfully increasing yields in testing, utilising biostimulants as a singular product.

The development and use of biostimulants is part of a broader shift towards more sustainable and resilient agricultural practices. As we are sure you’re aware, the increasing pressure on farmers to produce more food while minimising the environmental impact of agriculture has become a significant issue. Biostimulants help to meet this challenge head-on by improving crop yields and reducing the need for synthetic fertilisers and pesticides. They can also increase resilience to environmental stresses, which are becoming more common.

WHATS NEXT?

Driven by the demand for sustainable agricultural products, the global biostimulants market is projected to grow from USD$4.0 billion in 2024 to USD$9.8 billion by 2032.

This significant growth reflects a shift towards integrated nutrition systems that combine both biological and organic products to achieve efficiency in crop production systems.

In discussions with our network, the key highlight for everyday use cases is the interest around increasing stress resilience. Crop centres continue to encounter more frequent environmental stresses such as drought, flooding, high and low temperatures, and soil variabilities such as salinity and lower nutrients. Biostimulants make crops more resilient to these stresses and allow them to activate their stress defense mechanisms earlier and to a degree that does not completely wipe out the plant.

For interest beyond this newsletter, the team suggest having a look at Novosymes, Biolchin S.p.A and Valagro SpA. All of these are market leaders, driving innovcation in biosdtimulants and sustainable agriculture.

TOPIC #3 - CLIMATE TECH

Haven’t we seen this term thrown around over the last 12 months? It ultimately addresses any urgent challenge posed by climate change across sectors. This field, although diverse, is pivotal for the reduction or elimination of greenhouse gas (GHG) emissions and effective control of pollution levels.

While sustainable farming practices and precision farming help to reduce environmental footprints and increase food security, the drive towards development also emphasises the importance of reducing waste through innovative end markets in recycling and reuse, contributing to an overall more sustainable product lifecycle. Collectively, society can build a more resilient and sustainable future.

A particular topic of interest for this writer is the influence of AI, robotics, and computerisation on farming techniques. Utilising data collection to reduce GHG emissions, labour, and costs leads to an ever more efficient market. The ability to provide a growing population with access to unprocessed food groups and high levels of nutrition is the next challenge. What do you think is the most exciting part of this journey?

WHATS NEXT?

The diversity of climate tech makes it incredibly challenging to forecast the future market size of the space. Every month, new products, technologies, and solutions are being developed to encompass this idea.

In 2023, the climate tech market was valued at approximately USD$20.3 billion and is forecast to reach USD$130.9 billion by 2032. This anticipated growth is partially driven by government attention and policies. Increased policy recognition from the Council of Europe and other democratic societies is leading towards a drive for climate tech solutions. Further research from the World Economic Forum suggests that climate and ag-tech solutions could increase global output by USD 500 billion within the next decade, which would not only reduce the environmental impact but also increase food availability.

Nonetheless, financial aid is required to drive this innovation. With this increased growth, startups and founders will be looking to private markets to assist them in this journey. The need for specialised funding is ever more present, and Bloom Business expects alternative investment firms to be the core beneficiaries of this development due to their fluid and fast mandates.

QUIZ

See how you go on our tree nut quiz, released weekly on Mondays. Give it a crack and brag to your friends.

COMMUNITY

For our first edition, we are doing the typical: What would you like to see? As we aim to build out the best newsletter on the market for your morning digestables into Investing in Agriculture. Get in touch with us and share what works for you.